Property Tax Resources

Tax Data Reveals Plunge in Atlanta Commercial Property Values

"As of November 2010, 99.1% of appeals from the 2008 tax year had been resolved. For the 2009 tax year, 79.1% of appeals had reached a resolution; while only 16.4% of the cases from the 2010 tax year had been resolved...."

As in many U.S. markets, most property owners in Atlanta believe that commercial real estate values in the local market have been declining, and that the declining trend will continue. What is less clear to taxpayers and taxing entities is the severity of value losses and whether property taxes have come down to a corresponding degree.

An analysis of Atlanta-area commercial property valuations and property tax appeals in years past was conducted to determine if, indeed, the perceived drop in property values has occurred, and if so, what effect that drop had on property taxes. Possible new trends can also be extrapolated from the data.

Measuring loss: Which yardstick?

A review of commercial property sales tracked by CoStar Group confirms that asset values have declined since 2008. Yet the degree of decline varies depending on whether the data are broken down by the number of properties or by square foot.

On a per-unit basis, sale prices for multifamily, retail, office, industrial, healthcare, flex, hospitality and specialty properties in Atlanta-area zip codes fell 25% from the beginning of 2008 through the start of 2010. Looking at those same property types on a per square foot basis, it appears that values fell 15%. Taking those results together, we can say that commercial values have decreased by 15% to 25%, or about 20% on average, from Jan. 1, 2008 to Jan. 1, 2010.

The pool of commercial tax parcels in the city of Atlanta has remained fairly constant over the past three years. The number of commercial parcels in the city was 16,347 for tax year 2008, 16,280 for tax year 2009, and 16,184 for tax year 2010.

Appeals fluctuate

In 2008, 5,069 property owners in Atlanta filed tax appeals, representing approximately 31% of all commercial properties. For tax year 2009, the number of appeals filed by taxpayers fell to 2,087, or approximately 13% of all commercial properties; the number of appeals increased to 3,467 for tax year 2010, representing approximately 21% of the commercial properties.

One possible and likely explanation for the marked decrease in the number of appeals filed from tax year 2008 to tax year 2009 is that Fulton County mailed assessment notices for the revaluation of all commercial properties for tax year 2008. That gave city of Atlanta taxpayers the opportunity to file appeals from the notices. However, for tax year 2009, the County did not issue widespread assessment notices. Only taxpayers who received notices were informed enough to file returns of their opinion of value with the tax assessors and, thereby, were assured of receiving assessment notices from which to appeal.

As of November 2010, 99.1% of appeals from the 2008 tax year had been resolved. For the 2009 tax year, 79.1% of appeals had reached a resolution; while only 16.4% of the cases from the 2010 tax year had been resolved.

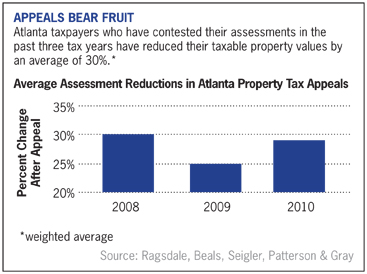

In cases from the 2008 tax year, resulting valuations averaged 30% less value than the original assessments. In the 2009 appeals, the average reduction in value was 25%. The few cases resolved from the 2010 tax year brought down the original assessments by an average of 29%.

Clearly then, Atlanta property values as well as Atlanta property taxes have dropped. On a weighted average basis across the three years, assessments reflect a reduction of approximately 30%.

In spite of the inherent limitations of analysis with many appeals still waiting for resolution, the available data from concluded appeals shows a clear trend: A significant number of commercial property owners in the Atlanta area have achieved substantial valuation reductions in the past three years.

New rules kick in

Under a change to state law effective in tax year 2011, which began on January 1, county taxing authorities will send notices of assessed property values to all Georgia taxpayers for each tax year. With this change to the law, property owners will no longer be required to file a return of their opinion of their property value with the county tax assessor in order to receive an assessment notice from which to appeal.

Based on an examination of the past years' data, it appears that approximately 16,000 assessment notices will be mailed to commercial property owners in Atlanta. Judging from recent trends, anywhere from 15% to 30% of those assessments will be appealed.

If the current trend of reductions in property values continues, then it is also to be expected that the filed appeals will result in valuation decreases for tax year 2011 as well.

American Property Tax Counsel

Recent Published Property Tax Articles

North Carolina Allows Look-Back Tax Exemption For Religious Uses

Lawmakers allow retroactive property tax exemption on religious grounds.

North Carolina has little sympathy for taxpayers that miss filing deadlines, but a new law eases the potential repercussions for property owners otherwise qualifying for religion-based tax exemptions. Under the new measure, taxpayers can apply for the religious exemption from property taxes...

Read moreSubsidies Pose Property Tax Puzzle in Public-Private Partnerships

With the number of public-private partnerships for constructing public facilities on the rise, communities across the country wrestle with the question of how to treat such arrangements for ad valorem property tax purposes. In most instances, private developers and taxing entities take opposing positions on the issue.

Public-private joint ventures have...

Read moreWhen Property Tax Rates Undermine Asset Value

Rate increases to offset a shrinking property tax base will further erode commercial real estate values.

Across the country, local governments are struggling to maintain revenue amid widespread property value declines, as a result they are resorting to tax rate increases. This funding challenge increases the burden on owners of commercial...

Read more