Property Tax Resources

A Taxing Situation in Cleveland

Owners at risk of unfairly high assessments pending Ohio Supreme Court guidance

"Recent history shows that districts are using sale prices to impose unreasonable tax burdens on taxpayers..."

Like much of the nation, Cleveland is experiencing sluggish but discernible improvements in its real estate market, and buyers are beginning to purchase real estate at prices that exceed the property's tax assessment value. The resulting real estate price volatility puts many Ohio property owners — and recent buyers in particular — at greater risk of receiving an unexpected and potentially unfair increase in their property tax bill. When property values are fragile, unexpected increases in expenses can be disastrous, and that includes an unexpected rise in real estate taxes. Ohio is one of the few states where school districts and other taxing entities have the legal authority to protest the assessed values of properties in their districts and to seek increases in taxable value. In fact it is customary for school districts in Ohio to seek an increased valuation and consequent rise in taxes on properties that have recently sold.

While the practice is customary, it is neither predictable nor uniform. The assessment on a property that recently sold can be significantly higher than the assessments on neighboring properties based on its sale price. Moreover, different taxing districts have different policies as to the extent and manner in which they pursue this remedy. For instance, some taxing districts may not aggressively chase sales. Others may seek not only to raise future assessments, but also to retroactively increase the assessment for the past year.

Taxing Sales

In many cases, a recent sale of real property is the best indication of its value, but there are exceptions. Modern real estate transactions frequently include the simultaneous transfer of non-real estate items, or the amount of consideration paid may reflect factors other than the fair market value of the real property. If these non-real estate items are not specifically identified and distinguished from the real estate value, they can be included in the value assigned to the property for files an increase complaint.

Recent history shows that with increasing frequency districts are using sale prices to impose unreasonable tax burdens on taxpayers. In an effort to correct this trend, on June 11, 2012, the state of Ohio enacted a statute that clearly states that real estate assessments must be based on fee simple estate, as if unencumbered. Moreover, the new statute further provides that where there is a recent arm's length sale, the auditor may consider the sale to be true value.

Read together, in order for the assessor to consider the sale price to be true value, that sale would have to reflect the fee simple estate, as if unencumbered. To understand why and how that is so important, it is useful to look back over developments in Ohio law over the past decade.

The Changing Law

Ohio law always provided that assessments shall be made based on true value and that "the auditor shall consider the sale price of such tract, lot, or parcel ... to be the true value for taxation." In 2005, the Ohio Supreme Court interpreted that statutory language to mean that there is no further evidence necessary to prove true value. Later, the Supreme Court expanded the ruling by stating that leased fee sales were also acceptable. (Leased fee value is based on a landlord's expected rental income from a leased property.) Even worse, later cases expanded the law to include leased fee transactions as comparable sales even when appraising fee simple, owner-occupied properties. And finally, other cases set precedents that precluded the county auditor, the state Board of Tax Appeals, or Common Pleas Courts from taking into consideration circumstances which indicated that the sale was not representative of market value. Despite the state's recent efforts to stop counties and school boards (which can file suits) from preying on investors buying property in Ohio, the trend has continued.

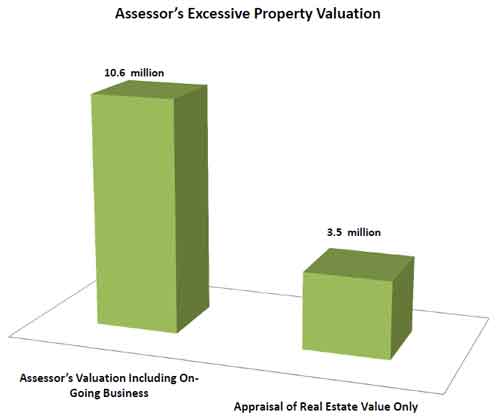

Real estate buyers in Cleveland must be even more careful to take appropriate steps to ensure fair treatment. As recently as March 2013, an assessor used the sale price of the ongoing business of a 127-bed nursing home, which was part of a sale that included 72 other nursing home operations in a multi-state transaction, to determine its assessed value. The sale price of the nursing home was $10.6 million, and the assessor valued the property at that price. The taxpayer's appraisal valued only the real estate, which came to $3.5 million (see chart). In short, the county is now taxing the value of the personal property and business operation at the nursing home when it only has authority to tax the real estate.

State lawmakers have attempted to make the law more uniform and equal by establishing a standard of fee simple, as if unencumbered, while providing flexibility to use a sale where it is warranted. What is still needed is guidance from the Supreme Court to enforce that standard.

Until the court has an appropriate case to provide that needed guidance, investors need to structure transactions with taxation in mind. To be recently purchased must be treated like those that have not been sold. Unfortunately, the burden falls on the parties in the transaction to make sure that all documents involved in the sale, particularly those that are recorded publicly, reflect only the real estate value.

Countermeasures Emerge

As an alternative, many investors have taken to purchasing the entity that owns the property rather than the real estate. Purchasing the entity eliminates the need to record a new deed, which is often the triggering event for school districts to file complaints seeking additional property taxes. As a result, the county may unknowingly be forced to treat all taxpayers alike. Moreover, state law prevents the schools from using the purchase of an entity to treat new buyers differently than existing owners. In 2000 and in 1998, the Ohio Supreme Court ruled that the sale price of all the shares of a company's stock does not establish the value of the company's real property. This is true even where the only asset of the company is its real estate. By purchasing an entity rather than the bare real estate, a taxpayer has at least a fighting chance to have equal treatment under the law. Given the complexities of such a transaction, however, buyers should seek local counsel when using this acquisition strategy.

American Property Tax Counsel

Recent Published Property Tax Articles

Subsidies Pose Property Tax Puzzle in Public-Private Partnerships

With the number of public-private partnerships for constructing public facilities on the rise, communities across the country wrestle with the question of how to treat such arrangements for ad valorem property tax purposes. In most instances, private developers and taxing entities take opposing positions on the issue.

Public-private joint ventures have...

Read moreWhen Property Tax Rates Undermine Asset Value

Rate increases to offset a shrinking property tax base will further erode commercial real estate values.

Across the country, local governments are struggling to maintain revenue amid widespread property value declines, as a result they are resorting to tax rate increases. This funding challenge increases the burden on owners of commercial...

Read morePennsylvania Court Reaffirms Fair Property Taxation Protection

A tax case in Allegheny County also spurs a judge to limit government's ability to initiate reassessments of individual properties.

Pennsylvania taxpayers recently scored an important victory when the Allegheny County Court of Common Pleas reasserted taxpayers' right to protection against property overassessment, while limiting taxing authorities' ability to proactively raise...

Read more