Property Tax Resources

Bay Area Governments Expand the Use of Transfer Taxes to Boost Collections

"Lately, cities and counties have been seeking ways to collect transfer tax from these legal entity transfers. For guidance, they have looked to California's property tax regime, which generally reassesses property when legal entity transfers occur..."

Property owners in and around San Francisco face an increasing tax burden as local governments attempt to bolster their struggling budgets by expanding the scope of transfer tax laws. In recent years, the cities of San Francisco and Oakland as well as Santa Clara County have gone beyond just collecting transfer tax when a deed is recorded, and now collect the tax for real property ownership changes that occur when one company buys or takes over another. The new laws may be working, as transfer tax revenues in all three jurisdictions have recently risen. From the time of its first implementation in the 1960s until recently, local governments only levied documentary or real property transfer taxes when a deed or other legal instrument was recorded based upon a transfer of "realty sold." The amount usually ranged from $0.55 cents to $3 for each increment in the reported price paid for the property.

However, the advent of new types of legal entities which are readily bought and sold has altered the way properties transfer now. As a result, the traditional system for collecting transfer tax via recorded deeds cannot always keep up with today's transactions.

For example, owners frequently transfer single-member limited liability companies and limited partnership interests to other owners. When these legal entities own real property, tracking real estate transfers can be difficult: While a deed is recorded when Company A sells real estate to Company B, no deed recording occurs when Company A buys a controlling interest in Company B, which owns real estate and continues to operate. Because the change in control of a legal entity that owns real property does not require a deed to be recorded, transfer tax is not collected when such legal entity transfers occur. Until now, that is.

New Implementation

Lately, cities and counties have been seeking ways to collect transfer tax from these legal entity transfers. For guidance, they have looked to California's property tax regime, which generally reassesses property when legal entity transfers occur. Amending their transfer tax laws to follow California's property tax system, jurisdictions have adopted ordinances that expand the scope of the transfer tax to include legal entity transfers. Santa Clara County was the first Bay Area jurisdiction to enact a transfer tax on legal entity transfers. The county's law imposes transfer tax whenever a legal entity that holds real property experiences a change in control, either directly or indirectly.

San Francisco adopted an easier approach. It simply redefined the term "realty sold" in the 1960s transfer tax statute to mean a change in ownership control for a legal entity that holds real property. Oakland followed suit, amending its law to include language similar to that in San Francisco's ordinance.

The amendments to these three Bay Area jurisdictions' laws were intended, at least in part, to close a perceived loophole in the transfer tax and thereby increase the amount of tax collected. For instance, when Oakland amended its transfer tax law, it expected to increase transfer tax revenues by $550,000 each year.

Amounts rising

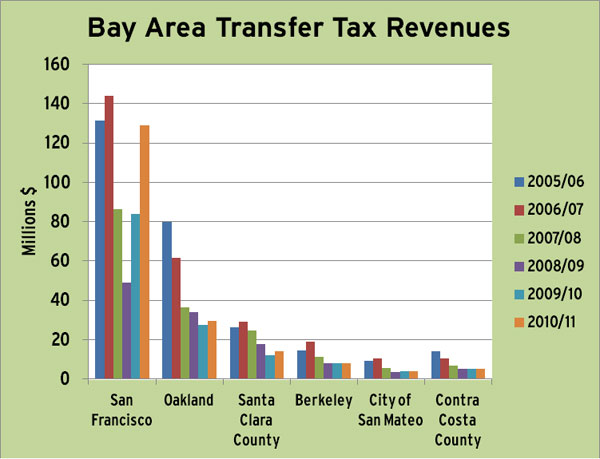

The strategy may be working. In the past one to two years, the amount of transfer tax collected by San Francisco, Oakland and Santa Clara County has been on the rise. By far, the largest rise was in San Francisco where collections have shot up by more than 160 percent over the past two years, while Oakland and Santa Clara County experienced modest gains in transfer tax revenues.

The reason for the increase is less clear. Obviously, a higher number of transactions due to the recovery of the Bay Area real estate market drove some of the surge. And in San Francisco, transfer tax revenues also rose because the city raised tax rates to 2 percent for transactions valued at more than $5 million and to 2.5 percent for transactions million or more, up from 1.5 percent previously.

For comparison, the amounts of transfer tax collected by Berkeley, the City of San Mateo and Contra Costa County—none of which collect transfer tax on legal entity transfers—have been flat in recent years. The experience of these other jurisdictions may be an indication that the expansion of transfer tax laws by San Francisco, Oakland and Santa Clara County to capture legal entity transfers is indeed having the intended effect.

To combat transfer taxes, property buyers should structure transactions to fall under one of the exceptions in California's transfer tax law. If an exception is not available, buyers should timely advise tax authorities of their transaction to avoid costly non-reporting penalties.

American Property Tax Counsel

Recent Published Property Tax Articles

North Carolina Allows Look-Back Tax Exemption For Religious Uses

Lawmakers allow retroactive property tax exemption on religious grounds.

North Carolina has little sympathy for taxpayers that miss filing deadlines, but a new law eases the potential repercussions for property owners otherwise qualifying for religion-based tax exemptions. Under the new measure, taxpayers can apply for the religious exemption from property taxes...

Read moreSubsidies Pose Property Tax Puzzle in Public-Private Partnerships

With the number of public-private partnerships for constructing public facilities on the rise, communities across the country wrestle with the question of how to treat such arrangements for ad valorem property tax purposes. In most instances, private developers and taxing entities take opposing positions on the issue.

Public-private joint ventures have...

Read moreWhen Property Tax Rates Undermine Asset Value

Rate increases to offset a shrinking property tax base will further erode commercial real estate values.

Across the country, local governments are struggling to maintain revenue amid widespread property value declines, as a result they are resorting to tax rate increases. This funding challenge increases the burden on owners of commercial...

Read more