Get Real About Tax Assessments

"A property's chain affiliation may affect its assessed value for property-tax purposes..."

Imagine this scenario: Two hotels in the same city are of similar age, size and construction quality. Both are located in popular areas with convenient access to sites attractive to overnight travelers. They're nearly indistinguishable — hotel guests would enjoy comparably satisfying overnight stays. But one hotel's assessed value for property-tax purposes is materially greater than the other. Why the difference?

There is a good chance that the hotel with the higher assessment operates under the flag of a recognized hotel chain and the other does not.

Should the flagged property's owner face the penalty of a higher tax bill because of the flag? Uniform appraisal standards and various state-tax authorities say that it should not. After all, tangible real property is assessed, not intangible personal property.

Moreover, in the past 10 to 12 years, several courts have handed down opinions that intangible value, such as that springing from a flagged hotel's identity, must be excluded from the real property's value. But including intangible value in the real-property assessment of properties such as flagged hotels remains an important and ongoing local property-tax issue across the country.

Other property types — such as restaurants, shopping malls, theaters, racetracks and casinos — also are affected by this issue. Property-owners and others concerned about their taxable values — e.g., potential buyers, their mortgage brokers, real estate agents and lenders — must be aware of this. Owners and buyers should be prepared to challenge assessments, and brokers should understand how to assure that these properties' tax valuations are performed correctly.

Property assessors and appraisers refer to the intangible value in varying fashions. They may talk about "business enterprise value," "going concern value" or "capitalized economic profit." But the basic concept is the same: It refers to including the intangible assets and rights that make the taxable property usable in the value. It is the value associated with the business operation, rather than the property itself.

There are three generally accepted approaches to valuing real property: the cost approach, the sales-comparison approach and the income-capitalization approach.

Regardless of the method used, assessors should be identifying and excluding all value outside of the real estate itself from the real property's value. How an assessment limits the property's valuation to the real estate's taxable value varies by approach.

The cost approach

Because this approach focuses on costs of land and improvements, it might appear unlikely that added value associated with the property's economic activity could embellish the assessment. Assessors must pay close attention to functional and economic obsolescence that may reduce the property's cost value, however. Functional obsolescence is the loss in a property's utility resulting from distinctive floor plans, site designs, or difficulty of upgrading or modifying property for a particular use, among other things.

Flagged or chain properties often are constructed according to designs specific to the chain. They also often have logos and other items that can hurt the real property's value because of the costs of modifying the property for other uses.

Economic obsolescence occurs because of external factors. For chain hotels, restaurants and other businesses, property-value reductions often come from market-demand changes because of a recession, changes in the public's tastes and market saturation with similar chain businesses.

Owners of chain-business properties more frequently cannot sell or lease property for as much as the tax-assessed value based on cost. Functional and economic obsolescence can factor into this.

An appraiser should identify and quantify the obsolescence and exclude it from the property's value. Failing to reduce the assessment for obsolescence may result in assessing the property too high because of characteristics attributable to the chain venture.

Sales-comparison approach

With this approach, appraisers analyze recent sales of comparable properties to determine the subject property's value. They adjust the comparable sales to quantify differences between the sold properties and the subject property. An appraisal used for real estate tax purposes should identify the intangible values reflected in the comparable properties' sales prices and eliminate them from the sales.

If sales of vacant properties, properties of non-chain-business enterprises, or sales of chain or flagged properties to non-chain operators who drop the chain affiliation are available, the sales approach should be used to avoid overstatement of value that otherwise might result.

Essentially, appraisers should use sales of comparable properties, sans the flagged or chain business, to arrive at a value.

The income approach

This approach aims to determine the property value by capitalizing the annual net operating income. For real estate assessment purposes, the income considered must come from the real estate only and not from the business interest occupying the property.

Thus, the income attributable to the property's intangible component — as well as to the tangible personal property — must be identified and extracted to arrive at a value. This can be difficult, but it is necessary if an appraisal relies on the income approach.

An appraiser might identify and analyze the comparable properties' incomes to develop a market value. As with the sales approach, in developing a model to determine market value based on income, the appraiser should select non-chain properties to avoid contaminating the data with associated intangible value and should reconcile income and expense items to account for property differences.

Regardless of the approach, a flagged property's value must be scrutinized to eliminate intangible value. The cost approach must account for functional and economic obsolescence. The sales approach must avoid inclusion of going-concern value in comparable sales. And the income approach should not entail simply a capitalization of the net operating income of the business occupying the property without isolating and eliminating business-enterprise value.

Owners of flagged or chain properties must be aware of how intangible value can disrupt property values and must be prepared to challenge assessments. Potential buyers should scrutinize appraisals for overvaluation arising out of the inclusion of intangible value. Brokers and lenders should approach appraisals with equal scrutiny in evaluating the security for mortgages. If intangible value is included in a flagged hotel's assessment and the hotel later loses its chain affiliation, the loan's security would be compromised. Lenders can mitigate this risk by being aware of the issue and assuring that any intangible value is identified and eliminated in the property's initial valuation.

Appraisers of flagged properties have the difficult task of identifying and quantifying intangible value attributable to a business enterprise and distinguishing it from the real property value. With diligent prodding from parties interested in the property's appraisal, an incorrectly large assessment is avoidable.

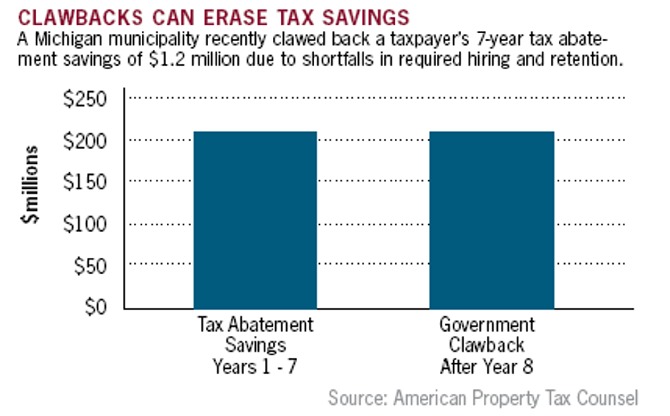

In some situations, a taxpayer should consider renegotiating the abatement agreement. A business can be in a surprisingly strong negotiating position, especially in instances where it can boast contributions to the local economy.

In some situations, a taxpayer should consider renegotiating the abatement agreement. A business can be in a surprisingly strong negotiating position, especially in instances where it can boast contributions to the local economy.

Prediction of a property's ability to generate income is precisely what the income approach to value in property assessment attempts to accomplish. The income approach estimates future benefits from ownership of the property. But this estimate requires extensive market research to evaluate risk factors in order to accurately predict income streams and expenses.

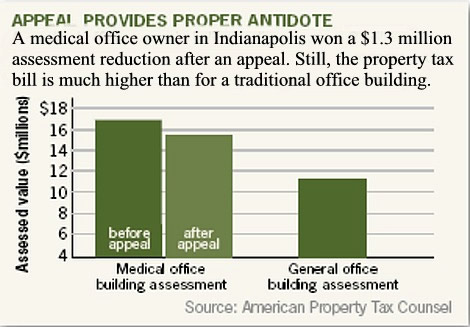

Prediction of a property's ability to generate income is precisely what the income approach to value in property assessment attempts to accomplish. The income approach estimates future benefits from ownership of the property. But this estimate requires extensive market research to evaluate risk factors in order to accurately predict income streams and expenses. As a result of this painstaking development and presentation of the relevant facts, the Appeal Board ruled in favor of the taxpayer and reduced the property's valuation by $1.3 million to $15.6 million. While this reduction was warranted, the medical office building remains valued higher than the general office building, proving that medical office buildings pay higher property taxes.

As a result of this painstaking development and presentation of the relevant facts, the Appeal Board ruled in favor of the taxpayer and reduced the property's valuation by $1.3 million to $15.6 million. While this reduction was warranted, the medical office building remains valued higher than the general office building, proving that medical office buildings pay higher property taxes.