"HBU is not a conclusion reached mechanically; it requires at least a bit of thought. Ignoring the chance that your current use is inferior to the HBU of your property is not a wise gamble."

By Elliott B. Pollack , Esq. and Richard R. Wright, as published by Corporate Real Estate Leader, September/October 2008

Before deciding to challenge the value of your property in U.S real estate tax appeal proceedings, spend a few moments considering its highest and best use as of the relevant date of value. Highest and best use is not an arid expression of appraisal jargon; it is a critical point of analysis for the property owner, in concert with his expert advisors and counsel, before putting his property in play.

Most states require real estate values to be determined, at least after informal proceedings have concluded, on the basis of expert testimony from appraisers. In order to furnish an opinion as to market value, it is necessary to have an understanding of a property's highest and best use. Market value, as we know, is the amount which in cash or cash equivalents would be paid to a knowledgeable seller by an equally knowledgeable buyer, both free of constraints not typical in the applicable market place.

Highest and best use (HBU) is the most valuable use, in terms of dollars (or these days, perhaps euros!) to which a property may be devoted. Many owners fall into the trap of making the unwarranted assumption that the current use of their property is its highest and best use.

In a dynamic real estate market, reflexively deciding that current use equals HBU can be dangerous. It's equivalent to believing absolutely that the future will be the same as the past.

HBU Isn't Always Visible in a Rear View Mirror

The current use of a property is the use to which it has been put based on past understandings of the market and historic economic judgments. Depending on how long ago that decision was made, its accuracy as a current HBU may be subject to challenge. Just because someone decided to construct a strip mall on a 20 acre tract of verdant farmland 20 years ago does not mean that the existing strip mall is the HBU today. Just because a service station was constructed on the corner of a busy intersection in one of New York City's five boroughs shouldn't blind the owner to a future user's objectives. And although a surface parking lot has been generating substantial monthly and transient revenues for its owner does not necessarily mean that a buyer would reach the same economic conclusion as to future use.

Of course, the less significant the buildings and improvements are on a parcel, the more likely a fresh look at HBU is required. But the fact that a major office building or hotel occupies a certain land parcel may have nothing to do with the future use to which the market tells us that the parcel should be put. And, of course after all, we must listen to the market if we are to correctly gauge market value!

The foregoing remarks suggest that if the current use is not economically advantageous, prosecuting a tax appeal may or may not make sense. For example, the obsolete hotel which faces demolition may or may not be replaced by a more economically valuable use. Viewed from the perspective of at least several years down the road, the property may currently be worth less for ad valorem tax purposes than the assessor believes. If, however, following demolition, the site is to be rapidly repositioned for an intensive mixed use development, the current hotel improvement may tell us less about market value than we think it does.

Gas Stations Typify Current HBU Issues

Should the owner of the abovementioned hypothetical gasoline station challenge her ad valorem assessment? Perhaps the station generates less revenue than she thinks it should, not as a result of fundamentals but due to a poor operation, grungy building, unattractive flag or changes in neighborhood traffic patterns. Poor economic results may also indicate that a use once thought to be one of the most commercially intensive and profitable uses available to a smaller parcel has been eclipsed by other uses.

Recent market data indicate that certain gasoline station sites were being sold at multiples of five and ten times what they would be worth as ongoing filling stations. Why? Research showed that developers have been able to reposition gas station properties for retail and, occasionally, residential uses, depending, of course, on the location and environmental compliance, due to changing neighborhood and macro-market conditions. Neighborhoods once thought to be somewhat unattractive are now in great demand to yuppies and empty nesters. The lack of urban development sites, measured against the rather modest improvements found at gas stations, has raised the value of some corner service stations beyond what they could ever fetch based on the current, use. The owner of that property might challenge her ad valorem assessment at his peril.

Conversely, the gasoline station owner may properly conclude that, if sold, her property would yield less than she thought. For example, new highway construction diverting traffic away from a formerly easily accessible and visible site might be one of many reasons for lowering HBU and therefore market value.

How Owners Can Use HBU

HBU represents the foundation of a real estate appraisal and, in almost every case, an assessor's or board of tax appeal's market value judgment. The Uniform Standards of Professional Appraisal Practice (USPAP), the "bible" to which appraisers must conform their work, tells us that appraisers must develop a market value opinion based on HBU. The factors to be reviewed by an appraiser include:

- The physical capabilities and potential of the site;

- The impact of applicable land use regulations;

- Economic supply and demand; and

- Neighborhood, local and regional economic factors

Many property owners, either acting themselves or through others, initiate ad valorem assessment review proceedings, if even on an informal basis, before an HBU judgment is reached. Sometimes, contests are initiated simply because taxes increased over a prior year or because some predetermined ratio of taxes to gross operating income has been violated. Hopefully, the foregoing discussion shows how unwise this approach can be in certain cases.

The pitfalls of bringing a tax appeal without thoughtful consideration of HBU are amply displayed by an actual event not involving the authors or their employers. A large commercial property developer engaged a consultant officed in a distant state to appear before the local Connecticut board to challenge the assessment of a vacant land parcel. He came charging up to the appeal on a snowy evening in early March. As part of his informal presentation, he showed the board a valuation analysis his client had prepared both on an "as vacant" and "as improved" basis. Since the property was in the midst of a hot development market, the board fastened on the "as improved" conclusion and tripled the assessment which the hapless fellow had come before it to appeal!

The same observation is applicable to ill considered assessment challenges which fail to recognize the likelihood of an assessor reaching a higher HBU opinion than the current use. Calling the property to the assessor's or the board's attention can trigger a reconsideration which will increase an assessment. Spending the time to consider the potential of this risk before rushing off to an assessment contest is highly recommended.

HBU is not a conclusion reached mechanically; it requires at least a bit of thought. Ignoring the chance that your current use is inferior to the HBU of your property is not a wise gamble.

Elliott B. Pollack is a member of Pullman & Comley in Hartford, Connecticut and chair of the firm's Valuation Department. The firm is the Connecticut member of American Property Tax Counsel. He can be reached at ebpollack@pullcom.com.

Elliott B. Pollack is a member of Pullman & Comley in Hartford, Connecticut and chair of the firm's Valuation Department. The firm is the Connecticut member of American Property Tax Counsel. He can be reached at ebpollack@pullcom.com.

Richard R. Wright is Senior Property Tax Manager of J.C. Penney Company, Inc. in Dallas, Texas.

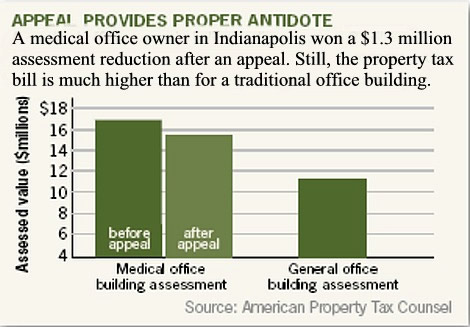

As a result of this painstaking development and presentation of the relevant facts, the Appeal Board ruled in favor of the taxpayer and reduced the property's valuation by $1.3 million to $15.6 million. While this reduction was warranted, the medical office building remains valued higher than the general office building, proving that medical office buildings pay higher property taxes.

As a result of this painstaking development and presentation of the relevant facts, the Appeal Board ruled in favor of the taxpayer and reduced the property's valuation by $1.3 million to $15.6 million. While this reduction was warranted, the medical office building remains valued higher than the general office building, proving that medical office buildings pay higher property taxes.

An owner or property manager examining the rental income from the office property above can rest easy because it's clear that no problem exists. Here's a well-managed property fully leased in a weak economy. However, taxpayers must not be lulled into ignoring the need for a review of any tax assessment received in an economy under duress.

An owner or property manager examining the rental income from the office property above can rest easy because it's clear that no problem exists. Here's a well-managed property fully leased in a weak economy. However, taxpayers must not be lulled into ignoring the need for a review of any tax assessment received in an economy under duress.

Assessors typically value golf courses using a cost approach. That approach starts with land value, adds the cost of property improvements, and subtracts physical depreciation. Assessors prefer the cost approach because the availability of cost data from national valuation services makes the determination of a value rather straightforward.

Assessors typically value golf courses using a cost approach. That approach starts with land value, adds the cost of property improvements, and subtracts physical depreciation. Assessors prefer the cost approach because the availability of cost data from national valuation services makes the determination of a value rather straightforward.