A firm understanding of how assessors apply market data locally comes in handy for savvy owners.

The real estate market is flourishing, as articles in Heartland Real Estate Business seem to confirm. Recent headlines such as “General Contractors are off to a Running Start,” and “Speculative Industrial Construction is Making a Come Back in St. Louis Market,” certainly are encouraging to readers.

But investors must remain diligent in keeping their assessed property values in check, or risk paying for their complacency later.

By monitoring assessments and challenging them when necessary, taxpayers can maximize profit and stay competitive when the cycle inevitably reaches its peak and the market begins to slide.

To minimize taxes, every taxpayer should understand the property tax system. That requires a grasp of local market dynamics and how assessors apply market data in establishing assessments.

Real estate taxes are merely a function of the tax rate multiplied by the assessment. The assessment is the measure that, if applied equally, and based solely upon bare real estate, that measure will yield uniform taxation for you.

Assessments tend to follow Newton’s law of inertia. Sales often set assessments in motion, but that doesn’t mean that sale prices always lead to assessments.

Price Versus Value

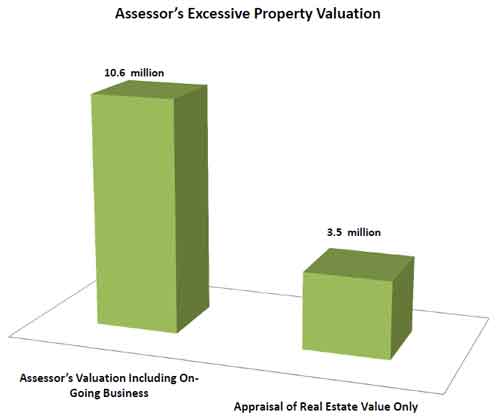

Too often, assessors confuse price with taxable value. Assessed or taxable value should be based on real estate alone. Sale prices, on the other hand, often reflect other factors that greatly affect the sale.

For instance, the business acumen of tenants and property managers often influence commercial property prices.

The lodging industry has an abundance of business and personal property value that is often difficult to distinguish from real estate value.

Hotel buyers are often purchasing in-place contracts, a workforce, personal property, reservation systems, the reputation of food and beverage providers, and other intangible items. As a result, the business value of a hotel tends to fluctuate more rapidly than the actual value of the “bricks and sticks.”

Because these intangible elements are factored into the sale, an assessment that is later based on the sale price will reflect more than the real estate value, unless the taxpayer takes the right steps to prevent that from happening.

What to look for

It is possible to strip away non-taxable components and turn a sale into a useful indicator of market value. An assessor can rely on a properly adjusted sale in the assessment of the subject property, and when valuing comparable properties. But what is the proper method of adjustment?

Excluding intangibles from taxable value can be an elusive goal. Investors often place tremendous value on the credit-worthiness of tenants, length of lease terms and other non-real-estate items. Those components depend on the occupant’s business rather than upon the location or condition of property improvements.

For assessment purposes, sales must be adjusted to reflect what the price would be if the tenant were a typical market tenant, paying market rent under current market lease terms.

State nuances

Taxpayers should consider not only the sale itself when evaluating for assessment, but also the particular state’s laws concerning assessments. For instance, Ohio recently amended its statutes to preserve it in assessments. Prior to the amendment, an assessor “must” have considered a recent sale price to be the new assessment of the property, regardless of any non-real-estate factors that might have affected the sale price.

Under the amended statute, assessors “may” use the sale, assuming that the sale reflects the “fee simple as if unencumbered value.” Thus, Ohio now takes a more nuanced approach, assessing properties based on market rents rather than in-place contract rents, along with the intention that assessors use market occupancy and market creditworthiness in assessments.

Taxpayers in other states have challenged assessment statutes to achieve more equal and taxation. Courts in Michigan addressed the concept of build-to-suit leases and contract rents, which the initial tenant pays in part to repay the developer’s costs, making contract rents incomparable with market rents.

Michigan now requires assessors to utilize market rents and other market indices to determine market value. Likewise, courts in Kansas and Wisconsin have established case law recently that requires more equal and assessment practices.

While there may be similarities between some states regarding their assessment laws, and a general trend of states moving toward more assessment, all states apply their laws differently.

Taxpayers must give due care to their state’s distinct approach.