Property Tax Resources

Golf Course Owners Teed Off Over Taxes

"Taxpayers are left to rely on the courts to compel assessors to value golf courses by present use and condition only..."

A battle is raging in New York and across the country between assessors and taxpayers at odds over the market value of golf courses and their associated membership clubs.

The front lines in this conflict are clearly demonstrated in Nassau County, N.Y., home to 400 overlapping tax districts and a population suffering the highest taxation burden in the state. The recession and nationwide decline in property values for golf courses have pushed many clubs into severe financial straits as thinning rosters force them to lower dues or scrap fees.

One prominent Long Island club recently sold to a developer. Another declared bankruptcy, and surviving golf courses are fighting to avoid similar fates. Closures outpace new openings as demand for golf declines and revenue growth remains flat in the face of rising costs especially property taxes.

One prominent Long Island club recently sold to a developer. Another declared bankruptcy, and surviving golf courses are fighting to avoid similar fates. Closures outpace new openings as demand for golf declines and revenue growth remains flat in the face of rising costs especially property taxes.

Exacerbating the tax problem are assessors who turn a blind eye to the economic forces threatening the survival of private clubs, and who instead pay undue attention to alternative land uses. Taxpayers are left to rely on the courts to compel assessors to value golf courses by present use and condition only.

In most all cases a golf course sells for a price that includes its business operation and personal property, but only the value of the real estate may be considered in setting the property tax assessment.

Development factor

Many courses are bought and sold for their development potential, grossly inflating values. Where developable land is at a premium, reliance on comparable sales could tax private golf courses from existence. The cost approach, too, is generally reserved for specialty property.

For these reasons, courts require the assessor to value the private golf course based on its value in use when employing the income capitalization approach. With this approach, a not-for-profit private club is valued as if it were a privately operated, for-profit, daily fee operation.

The courts tend to determine a golf course's income stream by capitalizing the amount a golf operator would pay a property owner as rent for the course. They use this methodology because golf course operators typically pay a percentage of gross revenues as rent. That amount can be capitalized to arrive at a value. The capitalization of golf rent to value is a hotly litigated issue and influences the percentage rent to be used.

Conflicting formula

Rents for golf course leases are influenced by differences in tax burdens from one location to the next. Similar golf courses operating under a similar operating basis, yet in differing locations with disparate tax burdens, must be equalized to arrive at a fair and uniform tax value. In a recent case, the court sought how best to keep the influence of high tax burdens from unfairly distorting value.

In that case, the assessor preached the application of an ad-hoc, subjective adjustment to the percentage rent to reflect a greater or lesser tax burden. This approach assumes the rental amounts would be triple-net. In a triple-net lease the tenant pays the real estate taxes, and the percentage rent is adjusted to reflect local taxes on a case-by-case basis.

The taxpayer offered another, more reliable method, the "assessor's formula". This formula lets the assessor follow the law, which calls for like-kind properties to be equally and uniformly assessed. The formula takes into account the income stream, the cap rate and the tax rate.

For example, consider two identical properties a city block apart, but in separate tax districts. One district has high tax rates, and the other a low tax rate. Because the assessor's formula weighs all three elements used to arrive at market value, it produces fair tax assessments as opposed to a subjective adjustment that is not computed on a scientific basis.

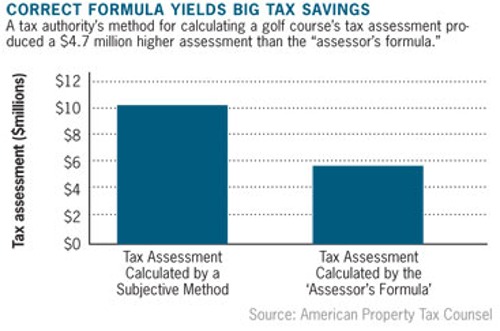

The accompanying chart shows the difference in assessments when the assessor's formula is used instead of an ad hoc, subjective tax adjustment. The assessor's formula provides a superior method that both assessor and taxpayer can rely on.

American Property Tax Counsel

Recent Published Property Tax Articles

Subsidies Pose Property Tax Puzzle in Public-Private Partnerships

With the number of public-private partnerships for constructing public facilities on the rise, communities across the country wrestle with the question of how to treat such arrangements for ad valorem property tax purposes. In most instances, private developers and taxing entities take opposing positions on the issue.

Public-private joint ventures have...

Read moreWhen Property Tax Rates Undermine Asset Value

Rate increases to offset a shrinking property tax base will further erode commercial real estate values.

Across the country, local governments are struggling to maintain revenue amid widespread property value declines, as a result they are resorting to tax rate increases. This funding challenge increases the burden on owners of commercial...

Read morePennsylvania Court Reaffirms Fair Property Taxation Protection

A tax case in Allegheny County also spurs a judge to limit government's ability to initiate reassessments of individual properties.

Pennsylvania taxpayers recently scored an important victory when the Allegheny County Court of Common Pleas reasserted taxpayers' right to protection against property overassessment, while limiting taxing authorities' ability to proactively raise...

Read more