Commercial property owners can maximize returns by minimizing property taxes, writes J. Kieran Jennings of Siegel Jennings Co. LPA.

Investing should be straightforward—and so should managing investments. Yet real estate, often labeled a "passive" investment, is anything but. Real estate investment done right may not be thrilling, but it requires active management, particularly in controlling one of the largest ongoing expenses, property taxes.

In recent years, the real estate industry has faced numerous challenges that harbored opportunities for savvy investors. From the COVID-19 pandemic and interest rate spikes to the work-from-home trend and increased vacancies, these disruptions were not just problems to solve—they were openings to reassess strategies, particularly regarding property taxes. Investors who seized these moments to reduce their tax burdens likely reaped significant benefits.

Consider the advice of the late judicial philosopher, writer and judge Learned Hand, who famously said: "Anyone may so arrange their affairs that their taxes shall be as low as possible; they are not bound to choose that pattern which will best pay the Treasury. There is not even a patriotic duty to increase one's taxes."

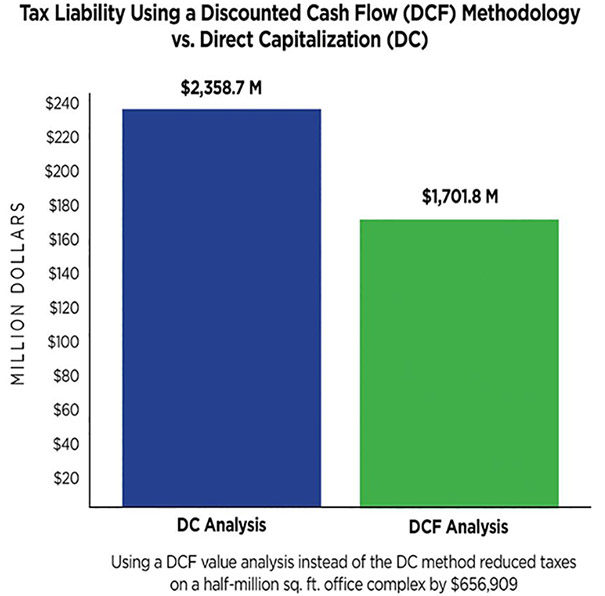

For real estate investors, this principle underscores the importance of addressing their largest tax expense: annual property taxes. These taxes not only erode returns year after year but can also negatively affect refinancing terms and eventual sales prices.

The best time to act? Now

Opportunities to reduce property taxes arise from shifting markets, new tax laws, court decisions, and even turnover among local assessors and prosecutors. Staying proactive means regularly reviewing these factors to determine whether each new assessment warrants a challenge.

To illustrate how market conditions and legal frameworks create opportunities, consider the following scenarios. Although these are hypothetical, they derive from true situations and case histories.

Tax is for tangibles: Soon after an investor purchased a hotel in Florida four years ago, the local assessor valued the property at 80 percent of its purchase price—a reasonable valuation for tax purposes at the time. Recent case law casts that value in a different light, however. Assessors must now exclude intangible business value, which can constitute up to 50 percent of a hotel's total value, from property tax liability. Ensuring the assessor valued their property correctly under the new directive enabled the subject property's owner to achieve a substantial reduction in the hotel's taxable valuation, saving tens of thousands of dollars annually.

Interest rates reconsidered: A multifamily complex acquired in 2021 was assessed at 90 percent of its purchase price. Although the owners had secured favorable interest rates at the time of acquisition, the taxpayer was still able to obtain a 30 percent assessment reduction in 2023. How? By citing the impact of rising interest rates on market conditions, which had suppressed property values due to buyers' increasing cost for debt financing. This assessment reduction helped improve the owners' cash flow and property valuation during refinancing negotiations.

Advanced to obsolescence. A newly constructed industrial facility in Ohio built to serve a rapidly developing industry faced obsolescence challenges as the needs of its intended tenant base changed in the evolving subsector. Under Ohio law, such properties are classified as special-use and must be assessed based on value to the user. The owners demonstrated significant economic obsolescence, effectively reducing the property's valuation. Additionally, the owners showed that many fixtures the assessor had initially included in the valuation were personal property. With strict adherence to legal definitions in revisiting the assessment, the assessor excluded the personal property from taxation. Understanding the legal definitions of assessable property and providing evidence of obsolescence enabled the owners to achieve meaningful tax savings.

These three examples highlight how market shifts and legal precedents create opportunities to lower tax burdens, even when the immediate need for action isn't obvious.

How to recognize a fair assessment

The methods for determining whether a property is fairly assessed depend on local and state laws, which vary widely and change frequently. Staying informed requires continuous monitoring of tax laws and local tax authority practices.

A taxpayer or tax advisor determined to stay current on local tax conditions should be sure to follow three key steps as part of their inquiries:

- Understand local laws and definitions. Assessors calculate fair market value based on jurisdiction-specific guidelines.

- Identify potential exemptions. Elements such as business fixtures might be reclassified as personal property and excluded from taxation.

- Evaluate risks. Be aware that challenging an assessment involves risks, which can range from minimal to significant, depending on local laws and circumstances.

Combining a thorough understanding of jurisdictional laws with an analysis of property-specific facts is critical. This approach ensures taxpayers know what evidence to produce and will know when they're being fairly assessed.

The bottom line is that commercial property owners must exercise vigilance, expertise and a proactive mindset to manage their property taxes effectively. By viewing challenges as opportunities, property owners can minimize expenses, maximize returns, and protect the long-term value of their assets. Regardless of whether an assessment appeal requires an attorney, thinking like a lawyer will yield dividends.